How To Maintain A Good Credit Score After Retirement

The question can come to your mind – Do you really need to worry about your credit score even after retirement?

The answer depends on whether or not you need to take out a loan. However, you don’t know when you feel the need for a loan.

If you have to obtain a loan in the future, you’ll thank yourself if you maintain a good score, as it helps to get favorable terms and conditions on the loan.

You may also have to take out a mortgage loan to refinance your existing home loan or buy a new rental home, and for that, a good credit score will help you a lot.

Apart from the reasons discussed above, there is another major reason to maintain a good credit score after retirement. That is, your existing creditors pull out your credit reports and scores periodically. So, if they don’t like anything on your credit reports, they can change the status of your existing credit accounts.

Therefore, try to maintain a healthy credit score ever in your retirement days. Check out the following 6 tips to maintain flawless credit reports and boost your score.

1. Check your credit reports periodically

Make it a habit of pulling out and checking your credit reports at regular intervals. Then, do some credit housecleaning.

A number of credit reports contain mistakes which need to be rectified by disputing them. You may get to see incorrect SSN (Social Security Number), misspelled a name, wrong payment updates, incorrect credit limits, etc. These things can reduce your score to some extent.

When you notice an error, dispute it by sending a copy of your credit report, highlighting the mistake, to the respective credit bureau.

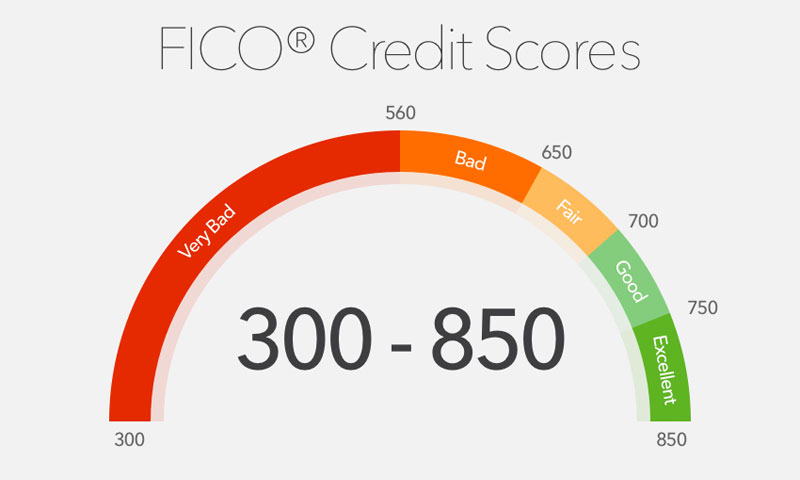

2. Know about your present credit score

Even after retirement, you should check your credit score at least once a year. As per law, you can request a free credit report from each of the bureaus once a year. However, you might have to pay extra to know your credit score.

Some websites offer a free credit score, such as Credit Karma and Credit Sesame.

3. Maintain a good credit utilization ratio

Try not to exceed 25% of your total credit limit to have a healthy credit utilization ratio. The financial experts suggest to maintain the credit utilization ratio below 20% to have a good credit score.

Therefore, if you swipe your card for a relatively bigger amount, you can make some payment before the payment due date. It will help you to use your card again and avoid the negative effect on your score.

Basically, you should try to keep balances as low as possible.

4. Request to increase your credit limit

Another way of raising your credit score is to ask for a credit limit increase. If you have maintained a good credit history by making on-time payments, usually your creditor will raise your credit limit.

You can qualify for a credit limit increase every year, even after retirement, if you maintain a good credit record and score.

In turn, a higher credit limit will help increase and maintain a good credit score.

5. Think twice before canceling your credit accounts

Actually, you don’t have to think to do this; never cancel your old credit accounts as it will shorten your credit history, thus lowering your score.

In your retired life, take advantage of a long credit history, which actually helps to boost the score.

If you have to make your personal finances manageable, cancel your relatively youngest credit accounts. However, even then, your credit utilization ratio will increase if you have debt on other credit cards, thus lowering your score.

6. Plan a budget and save as much as possible

It is difficult to have a true financial picture without a budget. Even after retirement, you will have to meet your daily necessities and may need to continue making payments on your car loan or mortgage.

So, plan a suitable budget after carefully analyzing your income and expenses. In turn, it will help you maintain a good credit score after retirement since you will manage your finances well.

Also, revisit your budget at least once every quarter, that is after 3 months, and make modifications if required.

You can seek the help of a good financial advisor to manage your money to make the most of it at retirement. An advisor can guide you about what investments you need to do to make a healthy flow of money and get better returns in the future days. You need to do investments to match inflation in the future days. So, consider all these, make proper financial planning, and enjoy your golden days to the fullest.